How to Divide a Business in High Net Worth Divorce

California Top Family Law Attorneys Christopher C. Melcher and Christina E. Djordjevich Explain How to Come Up with Creative Solutions when Dividing a Business in High Net Worth Divorce

I. Introduction

The world is changing but divorces go on. How can spouses deal with a business they can’t value or divide? This article discusses methods of division, focusing on in-kind division and deferred buy-outs, because of the difficulty in valuing businesses now, or finding liquidity for a buy-out. Holding company and nominee methods will be addressed, along with due diligence and tax problems.

There are three options for how to deal with a business interest in high net worth divorce: a buyout, sale, or co-ownership.

A buyout is the preferred option because there is a clean break, so the ex-spouses aren’t in business together. But valuation is difficult in an uncertain economy. Equalization can also be difficult because, usually, a family business is the largest asset the couple has, so there may not be enough other assets to award to one spouse in exchange for the other spouse getting the business.

The second option is a sale. However, many don’t want to sell their business interest because they’ve been growing it and developing it for several years.

That leaves us with the third option, which is co-ownership. But this is fraught with danger. The focus of this article is on how to structure the co-ownership of a business interest between spouses after divorce. It’s important to remember that this is only a temporary measure that will be in place until the parties can arrange a buyout or a sale. That is the end goal, until the business can be reliably valued, or until there’s enough cash to equalize the other spouse’s interest, so there can be a buyout. We can build a purchase option directly into the co-ownership agreement, so there will ultimately be a way out.

II. Co-Ownership Overview

◦ Co-ownership is not ideal, and should end when conditions improve. The end game will be a buy-out or sale. A purchase option can be built into the agreement.

A. The Moving Parts in Structuring a Co-Ownership Deal

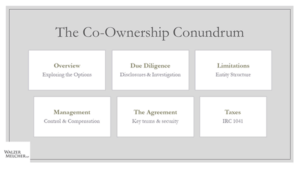

The options for co-ownership must be explored to determine what is feasible. Due diligence is required to know whether the plan will work, the risks, and how to document the transaction. Compensation to the operator spouse must be considered, along with the interplay of that compensation, and support orders. When a structure has been agreed upon, someone must draft the documents and ensure the transaction is tax efficient.

This Co-Ownership Conundrum Graphic shows the moving parts in structuring a co-ownership deal when dividing a business in a high net worth divorce.

B. Ownership vs. Management

Economic rights in an entity are proportional to the person’s ownership interest. Distributions follow equity.

Management and control rights over an entity need not follow the ownership interest. A manager can have no interest in the entity. A spouse can cede the right to manage and control to the other spouse. Co-ownership by former spouses typically involves one manager.

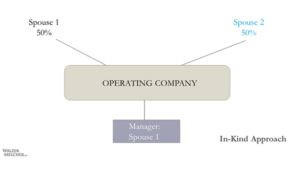

III. In-Kind Approach

◦ Equal division of community interest by creating a subordinate class of equity in the entity for the non-operator spouse, with reduced voting or management rights of, and protections, for the non-operator spouse.

A. Limitation on In-Kind Division

If the entity is owned solely by the spouses, it is easy to accomplish an in-kind division. But when there are other owners, those third parties often don’t want new partners. The formation documents for the entity often include anti-assignment provisions that prohibit transfers or assignments to others without consent of all owners. (Also, be aware of provisions that say a purported transfer allows the company to purchase the interest for a nominal sum.) If this is the case, we will have to find a work-around if the third-party owners do not consent. Although the court can order a spouse to do something, there are not a lot of options to overcome the resistance of third-party owners.

Successful businesses will usually have other owners, or a series of structures to hold assets, or perform management services. It seems like the more money these businesses make, the more layers of entities they have. They may have management and control in one entity, and they may have ownership of particular assets in other entities, all wrapped up into another operating company. So, you can have multiple layers of entities, and we have to go through the operating agreements, or shareholder agreements, for each entity to understand what can be done, and not just assume the divorce court can force solutions.

Negotiating with the other owners to allow the out-spouse to be an additional owner of record of the entity can be a long process. The other owners may not be open to bringing somebody in who is getting divorced from their business partner. That just sounds like a bad idea. Additionally, any such arrangement would need to be documented. Who is going to pay for business lawyers to review and redo all of the entity agreements? The business does not want to be involved in that. So, often the response from the other owners is “no, thank you.”

If we can’t convince the other owners to admit our client as a passive economic-only interest holder of the business, then we will have to look at how they can hold that economic-only interest without approval from the others. That leads us to consider the holding company or nominee approaches.

IV. Holding Company Approach

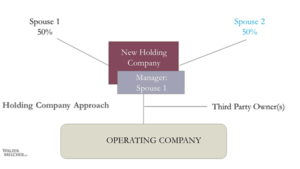

◦ New entity formed to hold spouses’ interests, with management rights assigned to one of them.

A. Choices for Holding Company

We will move now to the holding company approach. That means forming a new entity to hold the spouses’ interest, and that holding company would be the member, shareholder, or partner of the existing entity that operates the business. So, let’s consider the diagram above. The holding company that owns the interest in the operating company is in the middle. Spouse One is the manager and each spouse has a 50% interest in the holding company.

This structure will probably still need consent of the other owners, because the interest of the spouses in the existing entity will be transferred to the holding company. The third-party owners of the business should like this structure because Spouse One is the manager of the holding company (i.e., the same spouse who controlled the spouses’ interest in the business during the marriage will continue to do so in this arrangement). The holding company protects the spouses because each owns a 50% direct ownership interest in the holding company. So, if either spouse were to face bankruptcy, or credit or collection issues, the other spouse’s interest would not be affected. So we as divorce lawyers like this too.

This structure is also less offensive to the other owners of the operating company. Down at the bottom of the above diagram is the existing entity in which the spouses have a community or joint interest. Before the split, one spouse was holding the member interest of both spouses, without the other spouse being on record as an owner. All we are proposing is to substitute Spouse One for the holding company as the owner of the spouses’ interest. The holding company will have the same rights and responsibilities as Spouse One had, and Spouse One will continue to call the shots for the interest now held by the holding company.

Within the holding company, we can write all the protections and agreements we want about management of the holding company, compensation to the manager, fiduciary duties that the spouses owe to each other, the purchase option, etc. The other owners need not see or be concerned about those details. It’s a realistic alternative.

There are many choices for the structure of the holding company, and each option can provide for management rights to be separate from ownership rights:

• A limited partnership is the classic business structure for this arrangement, where the general partner manages, and the limited partners own.

• Limited liability companies are easy to form. There is a managing member who controls, and the members who own their interests and do not control.

• With a corporation, the spouses would each be shareholders, and a board of directors would govern. The spouses can agree on who will be on the board of directors.

• Or, you could create a trust, with the spouses as beneficiaries and a trustee who would have control. Some entity documents allow a transfer to trust.

B. Some Entities Cannot Hold Others

There are limitations on what types of entities can hold ownership interests in other entities, so you need to be mindful of that.

Assume the spouses own multiple nursing homes, with each set up as different entities. Some of those nursing homes own the real estate in which the homes are situated. Management of the nursing homes is conducted by a separate entity, and the intellectual property (e.g., trade name) is owned by yet another company. The spouses also own a captive insurance company to provide coverage for claims against the nursing homes. There is a different mix of partners between the entities, and a different mix of LLCs and S corporations. Sound complex? This arrangement is to be expected in a successful operation. Because the business is so valuable, there may not be funds for a buy-out, so the spouses are stuck with co-owning their interest.

Wrapping up the spouses’ interests in the entities into one holding company sounds tempting, but a holding company cannot hold all these things. There isn’t one entity that can hold it all. The easy way to understand the limitation is that the IRS does not want a pass-through company to hold another pass-through company. That may be an oversimplification of the rules, but helps sketch out the boundaries.

If we are using the holding company approach and we now want to create the H&W Holding Company, we have to select an entity type that can legally own the existing company(ies).

A pass-through entity, like a partnership, most LLCs, or an S Corporation, report taxes but do not pay taxes. The entity files a tax return for informational purposes, and the taxable income flows through directly to the owners, who report that income on a Schedule E to Form 1040. That type of entity can’t be held by another pass-through entity.

We may need a C-Corporation, a qualified sub-chapter S-trust, an electing small business trust, or maybe an irrevocable trust as the holding company, which will be difficult to form and administer. Business and tax counsel will be necessary.

C. Professional Entities

One important thing to remember regarding professional corporations is state law limits who can be owners. Only a professional can be an owner of a professional corporation. This is something to keep in mind as you’re thinking through the issues, and ask for help from business and tax counsel before proceeding.

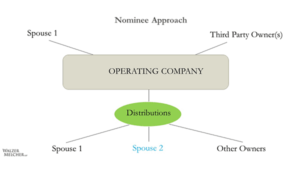

V. Nominee Approach

◦ Operator spouse continues to hold interest of both spouses, with accountability to distribute income.

A. Instructing the Entity to Distribute to Both Spouses, or Trusting the Operator Spouse to do it.

Often, because of the issues we’ve just addressed, we are left with the nominee approach. This scares family law attorneys, because we prefer a clean break and don’t want a situation where Spouse One continues to hold title to an interest on behalf of the other spouse. But sometimes this is simply the only way.

Spouse One must account for and turn over to Spouse Two a share of any income derived from the interest in the business. Usually this is the approach that we’re unfortunately stuck with. In the diagram, Spouse One continues to hold title in the operating company with the third-party owners. When the company is getting ready to distribute income, Spouse One would instruct the company to pay out distributions per the spouses’ agreement to each spouse directly.

You may need the consent of other owners because this is an assignment of Spouse One’s entitlement to the income from the company. If the other owners agree, or the entity does not restrict such assignments, then the company can be instructed to pay Spouse Two his or her share of the income directly. If not, the company will continue to distribute to Spouse One, and we will have to rely on that spouse to turn over Spouse Two’s share of income as required by their agreement.

We don’t like that. These parties have gone through a divorce. It’s putting a lot of trust into Spouse One, and Spouse One may not wish to be in the role of collecting and paying over the money, out of fear of claims by Spouse Two of being cheated.

B. Using Nominee Approach Pre-Trial

The focus of this article is settlement options, but this approach can also work pre-trial. Later, we will discuss the authority of the court to force situations like this, even when Spouse One or the third parties don’t agree, which can be requested as temporary measures or permanent solutions.

Divorces take a long time. It may be a multi-year litigation. If we have a business throwing off a lot of money during the divorce, do we trust Spouse One to receive the distributions, or do we want to ask for an order forcing the entity to distribute directly to our client? It may advantage Spouse One to divide income pre-trial with his or her spouse, to reduce exposure to claims for support or needs-based legal fees.

C. Bankruptcy Risk

A problem with the nominee approach is bankruptcy, because whenever a spouse holds an interest in his or her name, that person’s creditors can go after that. We don’t want our client’s interests taken by the other spouse’s creditors. Now, if they’re a community creditor, maybe that’s going to happen one way or the other. But if we can divide the interests and make our client the record owner of his or her own share, it provides protection.

The only way to do that is divide in-kind, but that may not be possible. The inherent risk of creditors in the nominee approach should be evaluated.

D. Orders Against Entity

The court cannot change the entity agreement, and that’s true even if you join the entity as a party to the divorce action. A good analogy is retirement plans. While we can divide benefits and direct payments, a court does not have the power to change the retirement plan. The same applies here. Whatever we ask the court to do has to fit within the construct of this entity.

That’s true even with the joinder. Courts have no authority to change the terms of an entity formation document, even when the company is joined as a party.

So, what can a court do? We know that orders can be made to protect the right to receive community income. Courts can make these orders, even without the third party being joined. California Family Code section 2045 allows the court to make injunctive orders against a third-party, without joinder in a dissolution proceeding, to protect the community interest. This is a good mechanism to get some quick relief without having to go through the joinder process, which can delay things. But section 2045 is limited to injunctive relief to prohibit transfers or other disposition of property, except in the usual course of business. We also have California Rule of Court, rule 5.18, which is broader than section 2045 because CRC 5.18 allows other relief besides just injunctive relief. That can be a useful tool.

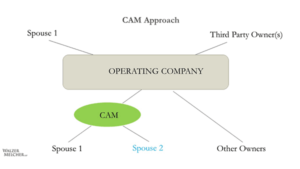

VI. Collection Account Management

◦ This is like the nominee approach, but income is paid to a neutral party by the entity, to distribute per instructions. CAM is like an escrow, used in the entertainment industry.

In film deals, multiple streams of revenue will come in that need to be distributed to rights holders. A collection account management (CAM) agreement facilitates those payments. The money is collected by a trusted person, like an escrow, then distributed.

We can adopt that process in divorce cases. The entity can be instructed to distribute money due to Spouse One to the CAM, which will then divide the funds between the spouses per their agreement.

The court may force this arrangement on the entity by filing a motion under section 2045 and rule 5.18, for relief against the entity, to compel them to make that payment attributable to the Spouse One’s interest in the business to the CAM.

Use “if, as, and when” language in the order, which clarifies the entity is only required to pay money over to the CAM “if” the entity makes a distribution to its owners, the payment need be made only “when” the entity makes the distribution, and the form of the payment will be done “as” it makes it to the owners. That does not intrude on operating the business. It doesn’t tell the business to make distributions. It just says that whenever you, in your discretion, make a distribution attributable to this spouse’s interest, you shall instead pay it over here.

That’s not intrusive. It is similar to a charging order, used in collecting judgments against the debtor for funds due to that party from an entity.

VII. Compensation

The next topic is compensation to the manager spouse during the period of co-ownership.

In formulating this co-ownership, we are contemplating that one spouse is going to manage the entity on behalf of both spouses, and that manager may be compensated for his or her services post-separation, and so it’s his or her separate property.

It is critical to deal with this upfront. You may need to get a reasonable compensation expert to opine, or help you come up with what the reasonable comp should be. But it’s critical to determine this up front with the co-ownership agreement, because otherwise, you are guaranteed to have a huge fight later because the operator spouse will likely say, “Any income that was generated that came out of the business during this period was compensation for my services. There’s nothing left over for distributions.” You get nothing, whereas the out spouse will obviously argue the opposite.

The parties can agree on a fixed amount, like a salary, or you can have a formula, which provides for an extra bonus amount based on the performance of the company, but it should be agreed upon in advance, in writing, and be crystal clear. Write into the agreement that the operator spouse cannot change his or her compensation. You don’t want to have a situation where you’ve done this co-ownership agreement, you’ve fixed compensation, and then the operator spouse goes to the entity and says, “Hey, give me a raise.”

One way of addressing compensation issues provides Spouse Two a proxy vote on a decision that deals with Spouse One’s compensation during the co-ownership period. It’s important to think through all these different issues because you’re running in parallel between the co-ownership agreement and the entity operations, just to make sure everything is consistent, everyone is on the same page, and there’s not some kind of conflict or work around. It’s going to end up prejudicing the out spouse.

VIII. Buy-out and Support Interplay

As teased at the beginning of this article, co-ownership is meant to be temporary; it’s a band-aid solution.

We’re going to have an option to buy out the other spouse usually baked into this agreement.

It might say that at the end of three years, there will be an option by Spouse One to purchase Spouse Two’s interest for $1 million. That could be exercised before then, or not. Or perhaps the buyout is required.

There could be installment payments along the way, and then by the end of three years, it’s done and paid for. We contemplate that the business will spin off income that’s above the reasonable compensation to Spouse One, and we will divide that excess income between the spouses for their ownership interests. Or, if you have this repurchase option baked in, part of the payments due Spouse One could be allocated to Spouse Two, as installment payments on the buyout. That way, we know it’s being funded, and there is not a gigantic balloon payment at the end.

There will be a support interplay. If we’re setting salary at $300,000 per year, we have to discuss whether support will be due on that salary.

IX. Duties of Manager

The next question is, what are the duties of the manager spouse to the other spouse during this period of co-ownership? As we know, fiduciary duties of spouses apply to one another regarding community property, until the community property is divided, and that’s under California Family Code section 1100, subdivision (e).

The question becomes, under these co-ownership approaches, has there been a division of community property such to keep the fiduciary duty in place, or to have it terminated?

Ultimately, it doesn’t matter, because you can provide for a duty of care and loyalty by contract, and for a fiduciary duty by contract.

There are differences between the duty of care and the duty of loyalty.

The duty of loyalty is faithfulness to the purpose of the contract, not to lie, cheat, or steal from the other spouse, and there are probably some disclosure obligations built into that. The duty of care involves decision-making by the manager to act, with ordinary care, on behalf of the entity. The manager will typically also be protected by the business judgment rule, that protects decisions made with ordinary care, in the ordinary course of business. In coming up with the co-ownership agreement, we want to think about what kind of decisions can be made unilaterally by the manager spouse? What kind of decisions require the consent of the out spouse? We should spell that out, just like any good partnership, business, any other entity document would do. The Uniform Partnership Act may be a place to look through, for how to lay this all out in a co-ownership agreement.

Another issue to consider is which decisions can be made unilaterally, versus those that require consent. The other thing is that all contracts have an implied covenant of good faith and fair dealing built in. That’s an added protection here as well. If the manager spouse is acting in bad faith, or frustrating the purpose of the contract, that can be actionable.

X. Due Diligence

We’re going to move now to due diligence, which is actually something to consider at the very outset, but we’ve saved it for the end.

It’s critical to do your due diligence to make sure that everyone is going into this co-ownership structure with eyes wide open, knowing everything there is to know about the business, and what could come up.

A. Business Counsel

Engage a business attorney early.

We are family lawyers, not business lawyers. Most of this falls into business law, not family law.

It’s great to be able to issue spot to know these things exist, but you’re going to want to engage a business counsel to do some of the heavy lifting on these items.

B. Company Documents

Request documents to verify the structure of the entity, its obligations, and your client’s guarantees.

For example:

◦ Articles of incorporation or organization

◦ Bylaws and minutes

◦ Stock register

◦ Shareholder or operating agreement

◦ Employment agreement with owner spouse

◦ Buy-sell agreements

◦ Financing agreements

◦ Guarantees

C. Voting Rights and Privileges

There may be different classes of voting. Super control may be built-in for one spouse, even though that party’s ownership interest in the company wouldn’t reflect that he or she could control the board.

◦ Are there different classes of voting rights?

◦ Who controls the board and appointments to the board?

◦ Is equity lost if an owner stops being a service provider?

XI. Creditors

It is very important to know who the creditors are, what’s owed, and how the debt is secured.

Are they secured through business property or other personal real estate?

A lot of this will be obvious from the entity documents, like loan agreements, balance sheets, and payments to creditors. Don’t forget landlords, because leases for business premises may include a personal guarantee from an owner of the company. If a spouse has given a personal guarantee, this could have huge implications if a default occurs.

Tax authorities are also creditors, not just for federal and state income tax, so also look for unpaid sales tax and payroll taxes. These are significant and the business attorney could assist in advising on those. Some issues to look out for:

◦ Who are they and what is owed?

◦ Security interests of others in business property

◦ Don’t forget landlords and taxing authorities

◦ Personal guarantees or personal liability

◦ Check for covenants against transfer or assignment

◦ Claims or litigation involving company

XII. Disclosures

The operating spouse should disclose any material facts or opportunities about the business.

These can be stated as representations and warranties in the agreement.

◦ Any planned sale or other events expected?

◦ Other material facts relating to operation or continuity of business

XIII. Non-Compete

Consider an agreement from the bought-out spouse not to compete with the business.

Even though that spouse did not operate the business, he or she may have enough knowledge to take customers or market share from the spouse who paid for the business.

XIV. Security

Look at a QDRO to secure the buy-out payment against the spouse’s retirement accounts.

This is authorized by IRC 401(a)(13)(B), PLR 9234014 and PLR 200252093. The plan benefits awarded to the former spouse in the judgment can be pledged as security for that spouse’s obligations under the judgment.

XV. Taxes

IRC Section 1041 says no gain or loss is recognized on a transfer to a spouse or former spouse incident to divorce.

We know it’s incident to divorce if the transfer occurs within one year of the termination of marriage. It’s presumed the transfer is presumed to be related to the cessation of divorce, if the transfer occurs within six years of divorce, and if the divorce instruments require the transfer.

With co-ownership, the parties will be partners beyond a year. There will hopefully be a buy-out by the sixth year, so IRC 1041 applies. The divorce instrument should spell out that the intent is to be covered under IRC 1041.

If the buy-out is beyond six years, there is a presumption that IRC Section 1041 does not apply, but you can still rebut the presumption by laying out the facts as to why it was impractical for the transfer to have occurred within the six years. There could be reasons, like liquidity or disputes with the other owners, as to why the transfer could not occur within 6 years.

XVI. conclusion

That brings us to the end of the article. Most of this was corporate law, business law, and a little tax. Knowing these areas of law allows us to be creative and effective problem solvers for our clients.